The Statistical Mechanics of Financial Markets

By Johannes Voit

Category

StrategyRecommended by

"The Statistical Mechanics of Financial Markets" by Johannes Voit is an in-depth and illuminating exploration of the complex dynamics at play in financial markets. Drawing upon principles of statistical mechanics, Voit provides a comprehensive framework for understanding the behavior and interactions of various market participants.

The book begins by establishing the foundation of statistical mechanics, explaining its relevance and application in the context of financial markets. Voit then introduces key concepts such as equilibrium, entropy, and information theory, illustrating how these principles can shed light on market dynamics.

Throughout the book, Voit emphasizes the importance of modeling financial markets as complex systems, where a multitude of factors interact and evolve over time. He explores the role of randomness, noise, and feedback mechanisms in shaping price fluctuations and volatility, highlighting the limitations of traditional economic models.

Voit also delves into the concept of market efficiency and presents a nuanced analysis of the efficient market hypothesis. He discusses the interplay between rational and irrational investor behavior, exploring empirical findings and psychological factors that contribute to market anomalies.

Furthermore, Voit examines the emerging field of agent-based modeling and its applications in financial markets. He showcases how incorporating individual agent interactions and decision-making processes can yield valuable insights into market dynamics and the formation of price patterns.

In conclusion, "The Statistical Mechanics of Financial Markets" provides a comprehensive and rigorous exploration of the quantitative principles underlying financial markets. Aimed at researchers, practitioners, and students in the field, this book offers a fresh perspective on market dynamics, facilitating a deeper understanding of the complexities inherent in financial systems.

The book begins by establishing the foundation of statistical mechanics, explaining its relevance and application in the context of financial markets. Voit then introduces key concepts such as equilibrium, entropy, and information theory, illustrating how these principles can shed light on market dynamics.

Throughout the book, Voit emphasizes the importance of modeling financial markets as complex systems, where a multitude of factors interact and evolve over time. He explores the role of randomness, noise, and feedback mechanisms in shaping price fluctuations and volatility, highlighting the limitations of traditional economic models.

Voit also delves into the concept of market efficiency and presents a nuanced analysis of the efficient market hypothesis. He discusses the interplay between rational and irrational investor behavior, exploring empirical findings and psychological factors that contribute to market anomalies.

Furthermore, Voit examines the emerging field of agent-based modeling and its applications in financial markets. He showcases how incorporating individual agent interactions and decision-making processes can yield valuable insights into market dynamics and the formation of price patterns.

In conclusion, "The Statistical Mechanics of Financial Markets" provides a comprehensive and rigorous exploration of the quantitative principles underlying financial markets. Aimed at researchers, practitioners, and students in the field, this book offers a fresh perspective on market dynamics, facilitating a deeper understanding of the complexities inherent in financial systems.

Share This Book 📚

More Books in Strategy

Against The Gods

Peter Bernstein

How To Decide

Annie Duke

A Few Lessons from Sherlock Holmes

Peter Bevelin

Adapt

Tim Harford

Clear Thinking

Shane Parrish

Competitive Strategy

Michael Porter

Deep Survival

Laurence Gonzales

Secrets of Power Negotiating

Roger Dawson

The Formula

Albert-László Barabási

The Hour Between Dog and Wolf

John Coates

Think Like a Rocket Scientist

Ozan Varol

Think Twice

Michael Mauboussin

100 Deadly Skills

Clint Emerson

Bet With the Best

Andrew Beyer

Bringing Down The House

Ben Mezrich

Competition Demystified

Bruce Greenwald

Diaminds

Mihnea Moldoveanu

Farsighted

Steven Johnson

Fortune's Formula

William Poundstone

Getting Past No

William Ury

How Google Works

Eric Schmidt

How to Get Lucky

Max Gunther

In-N-Out Burger

Stacy Perman

Innovation and Entrepreneurship

Peter Drucker

Insanely Simple

Ken Segall

Payoff

Dan Ariely

Pebbles of Perception

Laurence Enderson

Play Bigger

Al Ramadan

Radical Uncertainty

John Kay

Rational Decisions

Ken Binmore

Popular Books Recommended by Great Minds 📚

Bad Blood

John Carreyrou

Red Notice

Bill Browder

Mindset

Carol Dweck

Give and Take

Adam Grant

Destined For War

Graham Allison

7 Powers

Hamilton Helmer

American Kingpin

Nick Bilton

Economics in One Lesson

Henry Hazlitt

Hillbilly Elegy

J.D. Vance

The Innovators Dilemma

Clayton Christensen

Hopping Over The Rabbit Hole

Anthony Scaramucci

The True Believer

Eric Hoffer

Meditations

Marcus Aurelius

Antifragile

Nassim Nicholas Taleb

Wanting

Luke Burgis

The Third Wave

Steve Case

1984

George Orwell

Atlas Shrugged

Ayn Rand

The Psychology of Money

Morgan Housel

Good To Great

Jim Collins

Range

David Epstein

Blitzscaling

Reid Hoffman

Who We Are and How We Got Here

David Reich

The Outsiders

William Thorndike

Extreme Ownership

Jocko Willink

The Coddling of the American Mind

Greg Lukianoff & Jonathan Haidt

Superforecasting

Philip Tetlock

Dune

Frank Herbert

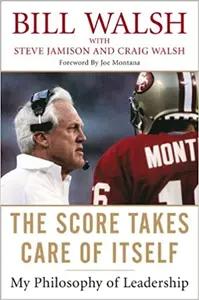

The Score Takes Care of Itself

Bill Walsh

Behave

Robert Sapolsky