Homebrew Partner Satya Patel on path from seed to Series A: 3 keys to resonance w/investors | Summary and Q&A

TL;DR

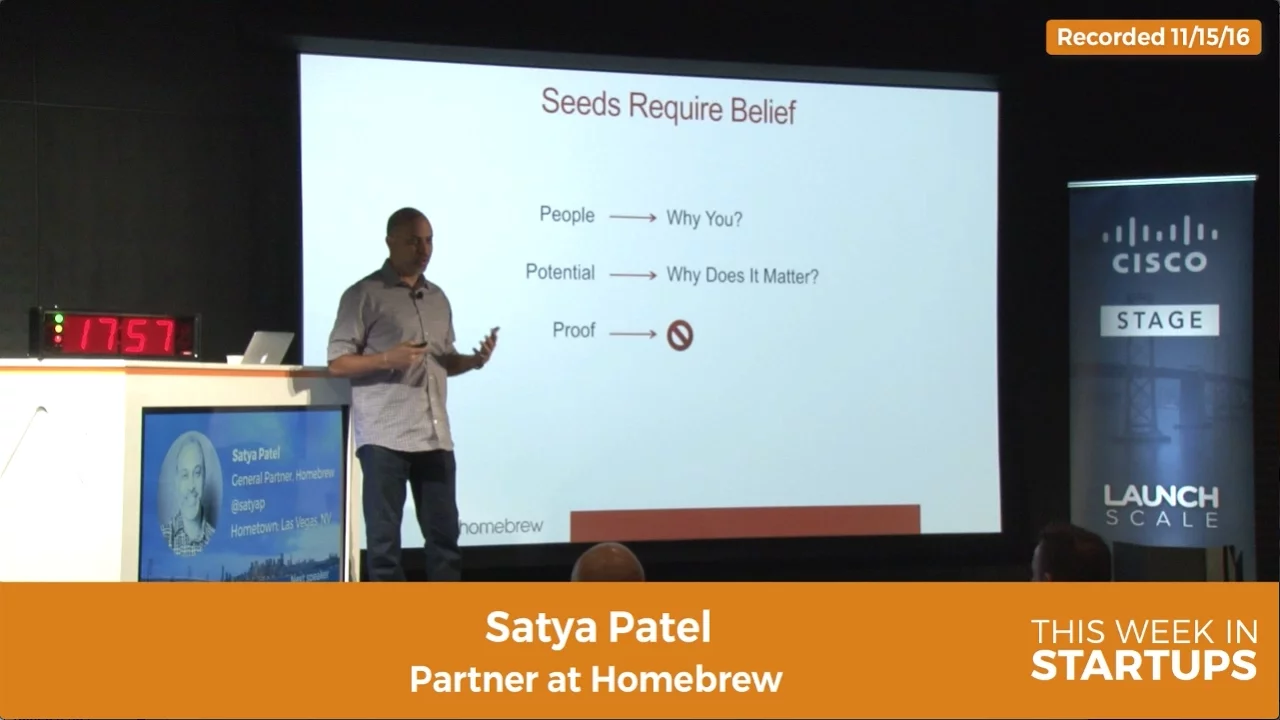

Emotional resonance plays a crucial role in startup financing as it involves investors irrationally believing in the potential success of a business, focusing on the people and their story, the potential impact, and the lack of proof or data at the early seed stage.

Key Insights

- 🧑🏭 Belief and emotional resonance are crucial factors in securing startup financing.

- 😤 The team's story and motivation, as well as their unique insights, create emotional resonance with investors.

- 🧑🏭 The potential impact of the business on the world and the market opportunity are significant factors in attracting investors.

- ❓ Proof and data become more critical in later stages of financing.

- ⚖️ Early-stage funding now requires startups to establish product market fit and demonstrate scale.

- 😀 Later-stage investors face challenges due to overpaid assets and lack of liquidity in the market.

- 📁 Direct-to-consumer products like Blue Apron focus on optimizing the customer experience to succeed.

Transcript

Read and summarize the transcript of this video on Glasp Reader (beta).

Questions & Answers

Q: What is emotional resonance in startup financing?

Emotional resonance refers to the ability of a startup to connect with investors on an emotional level, making them irrationally believe in the potential success of the business. It involves telling a compelling story about the team, emphasizing their motivation and unique insights into the market.

Q: Why is the potential impact of the business important in startup financing?

Investors need to understand why the problem the startup is solving matters and why they should believe in its solution. The potential impact showcases the market opportunity and the relevance of the startup's mission, creating emotional resonance and attracting investors.

Q: Why is proof or data less important at the seed stage?

At the early seed stage, startups often lack significant proof or data to support their claims. However, investors understand this and focus more on the potential, the team, and the emotional resonance created by the founders' story and vision. Proof and data become more critical in later stages of financing.

Q: How has the financing path for startups changed?

The financing path for startups has evolved, with early-stage funding now requiring both product market fit and the ability to demonstrate scale. Startups need to use their seed funding to establish product market fit and show investors the potential for significant growth and scalability.

Summary & Key Takeaways

-

Emotional resonance, driven by belief, is essential in securing startup financing, as it involves convincing investors to believe in the potential success of the business.

-

The three key factors for emotional resonance are the people (team), the potential impact of the business, and the lack of proof or data at the seed stage.

-

The financing path for startups has changed, with early-stage funding requiring the establishment of product market fit and demonstration of scale.

Share This Summary 📚

Explore More Summaries from This Week in Startups 📚