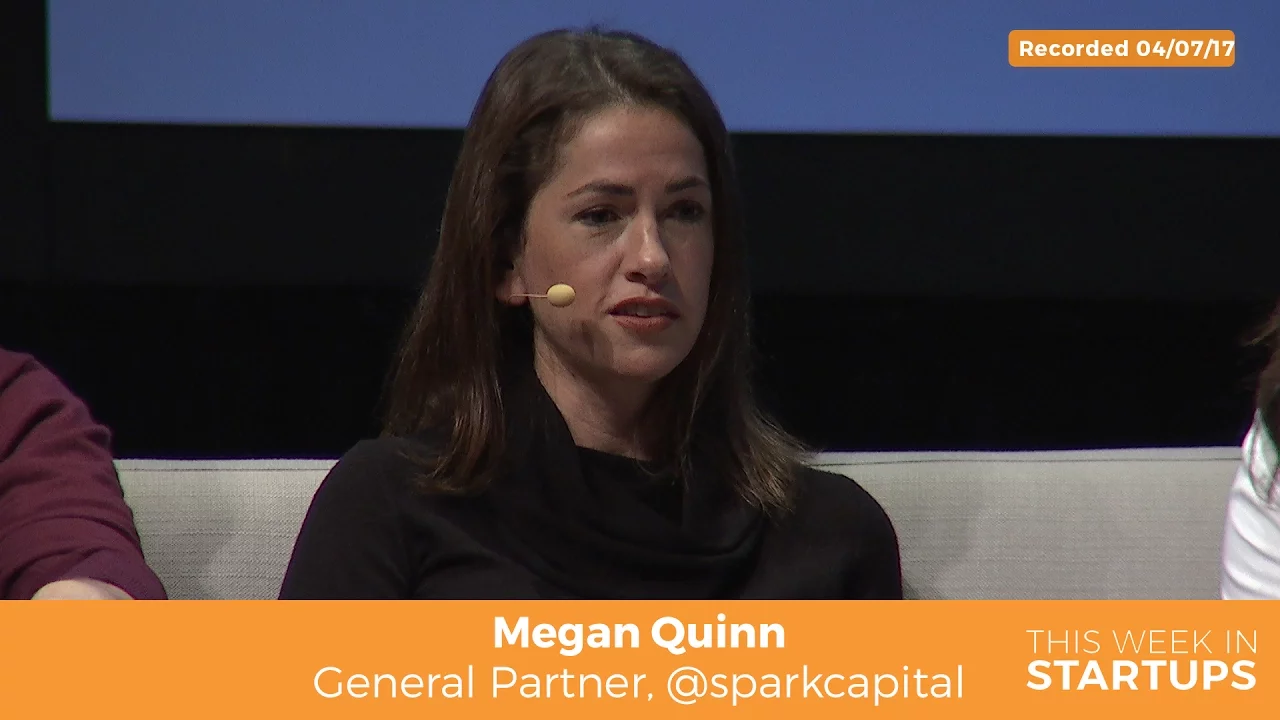

Megan Quinn of Spark Capital on VC funding myth & why equity crowdfunding is a great trend | Summary and Q&A

TL;DR

Crowdfunding provides an alternative to traditional venture capital, expanding access to capital for startups that do not fit the typical funding model.

Key Insights

- 🗯️ Venture capital is not the right funding structure for all startups, and crowdfunding offers an alternative.

- 🚙 Distributed equity vehicles like crowdfunding provide smaller amounts of capital to startups.

- ❓ When assessing investors or syndicates, consider their contribution beyond monetary investments.

- 🔠 Startups that don't fit traditional venture capital requirements can benefit from alternative funding sources.

- ❓ Crowdfunding can provide mentorship and advice to early-stage startups.

- 🔇 The Casper mattress, a product unrelated to the content, is highly recommended by the speaker.

- 🎚️ Casper mattresses combine memory foam with an ideal level of support and bounce.

Transcript

Read and summarize the transcript of this video on Glasp Reader (beta).

Questions & Answers

Q: How does crowdfunding provide an alternative to traditional venture capital?

Crowdfunding allows startups to raise small amounts of capital from a large number of individual investors, eliminating the need for traditional venture capital firms.

Q: What are the limitations of traditional venture capital as a funding structure?

Traditional venture capital has strict ownership and exit requirements that may not be suitable for all startups. It may require startups to fit a specific model, leaving out many potential companies.

Q: Should entrepreneurs be concerned about syndicates from venture capital firms investing in their startups?

It is important to assess the value that syndicate members bring beyond monetary investment. If they have not provided meaningful advice or mentorship, it may indicate a lack of proper development.

Q: How does crowdfunding benefit early-stage startups in particular?

Crowdfunding provides early-stage startups with access to capital and potential mentorship that they may not have received otherwise, helping them navigate the critical early stages of company formation.

Summary & Key Takeaways

-

Crowdfunding and other distributed equity vehicles offer small amounts of capital and are a great alternative to traditional venture capital for startups.

-

Traditional venture capital may not be the right funding structure for the majority of companies, and crowdfunding opens up another avenue of capital for startups.

-

When evaluating syndicates or investors, it is important to consider not only the monetary investment but also their time, advice, and mentorship.

Share This Summary 📚

Explore More Summaries from This Week in Startups 📚