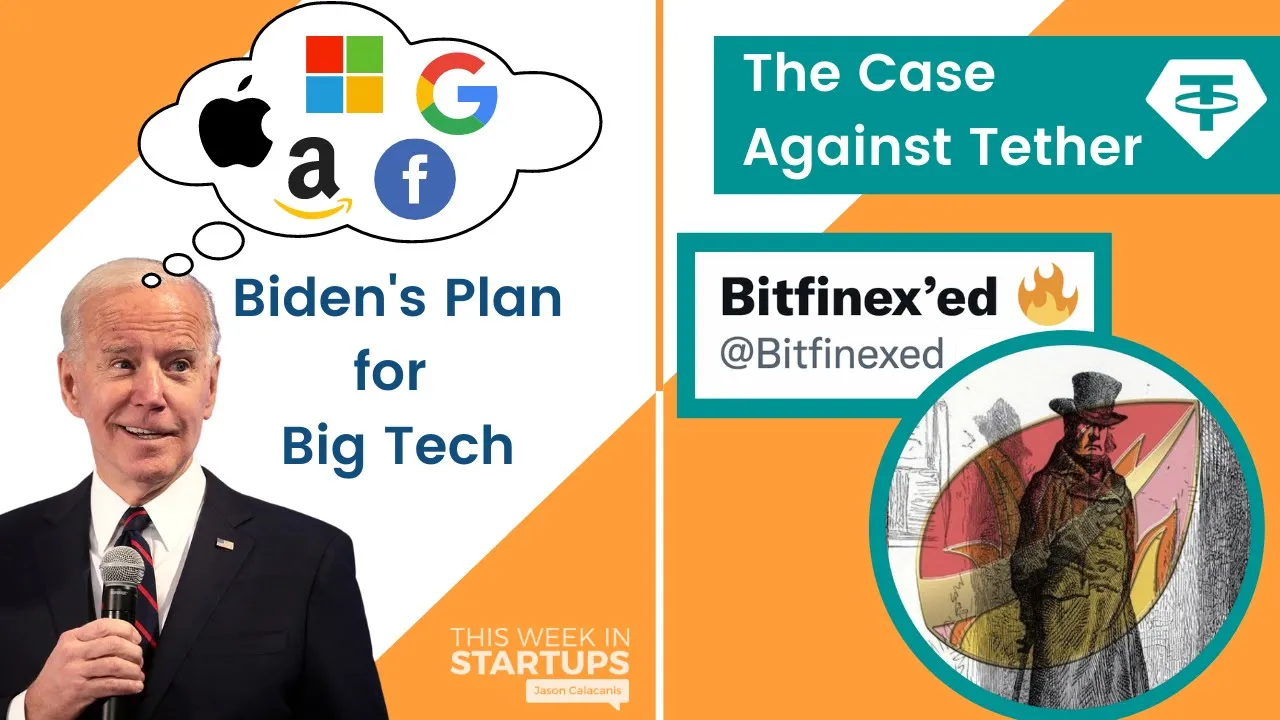

Biden targets big corporations + Tether Investigation with Bitfinex’ed | E1243 | Summary and Q&A

TL;DR

Tether, a stablecoin tied to the US dollar, has raised concerns about its legitimacy, with red flags including contradictory terms of service, missing funds, and potential market manipulation.

Key Insights

- 📫 Tether's terms of service raised red flags by stating that tethers were not redeemable for money, contradicting their marketing claims.

- 📔 Bitfinex and Tether are closely linked, and evidence suggests that they co-mingled funds and covered up missing money.

- 🤨 Tether's potential manipulation of the market through its stablecoin raises concerns about the overall stability and integrity of the cryptocurrency market.

- 🇳🇨 The involvement of the New York Attorney General indicates the seriousness of the allegations against Tether and Bitfinex.

Transcript

Read and summarize the transcript of this video on Glasp Reader (beta).

Questions & Answers

Q: What is Tether and why is it causing controversy?

Tether is a stablecoin backed by the US dollar, but concerns have emerged due to contradictory terms of service and the potential manipulation of the market.

Q: How did the New York Attorney General get involved in the investigation?

The New York Attorney General started investigating Tether and Bitfinex in 2018, leading to a lawsuit against them for co-mingling funds and covering up missing money.

Q: What is the potential impact if Tether is found to be fraudulent?

If Tether is proven to be a massive fraud, it could trigger a financial crisis in the cryptocurrency market, as Tether's activity drives its liquidity.

Q: Why haven't more people redeemed their Tether holdings?

Despite concerns about Tether's legitimacy, there hasn't been a significant mass redemption of Tether. It is unclear why some users continue to hold onto their Tether tokens.

Summary & Key Takeaways

-

Tether was created to address the banking issues faced by Bitcoin exchanges, offering a stable digital currency backed by the US dollar.

-

Concerns arose when Tether's terms of service revealed that the token was not redeemable and lacked a guarantee of value.

-

Bitfinex, a major cryptocurrency exchange, and Tether are closely linked, with evidence suggesting that they co-mingled funds and covered up missing money.

Share This Summary 📚

Explore More Summaries from This Week in Startups 📚