Defined Benefit Pension: The Finance of Retirement and Pensions PREVIEW | Summary and Q&A

Transcript

Read and summarize the transcript of this video on Glasp Reader (beta).

Summary

This lecture provides an introduction to defined benefit (DB) pensions, highlighting their prevalence and differences compared to defined contribution (DC) plans. It explains the significance of understanding DB pension arrangements for both recipients and taxpayers, and discusses the challenges faced by employers in providing guaranteed payments. The lecture also emphasizes the exposure to DB pension risk that shareholders may have. Whether you are directly involved in a DB plan or not, it is important to comprehend the implications and obligations associated with these pension arrangements.

Questions & Answers

Q: What is a defined benefit pension?

A defined benefit pension is a retirement benefit provided by an employer to a worker in the form of a monthly payment that begins upon retirement. The amount of this monthly benefit is predetermined and known in advance, hence the name "defined benefit."

Q: How common are DB pensions in the United States?

According to the latest data, only about 17% of private-sector employees participate in DB pension plans. In contrast, 78% of state or local government employees, as well as many federal government employees, are enrolled in DB plans.

Q: What is the difference between DB and DC plans in terms of participation rates?

Private-sector employees are more likely to participate in DC plans, such as the 401(k), with over 40% of them being enrolled in such plans. On the other hand, only 15% of public sector employees participate in DC plans. It is worth noting that almost everyone with access to a DB plan tends to participate in it, indicating a perceived advantage of DB pensions.

Q: Why should individuals without a DB pension still care about understanding these arrangements?

Even if you do not have a DB pension personally, as a U.S. citizen, your tax dollars contribute to the pension plans offered by federal, state, and possibly local governments. This means that as a taxpayer, you indirectly offer DB pensions to government employees. Therefore, it is crucial to understand these arrangements as they directly affect you as an employer, influencing spending decisions and obligations towards employees.

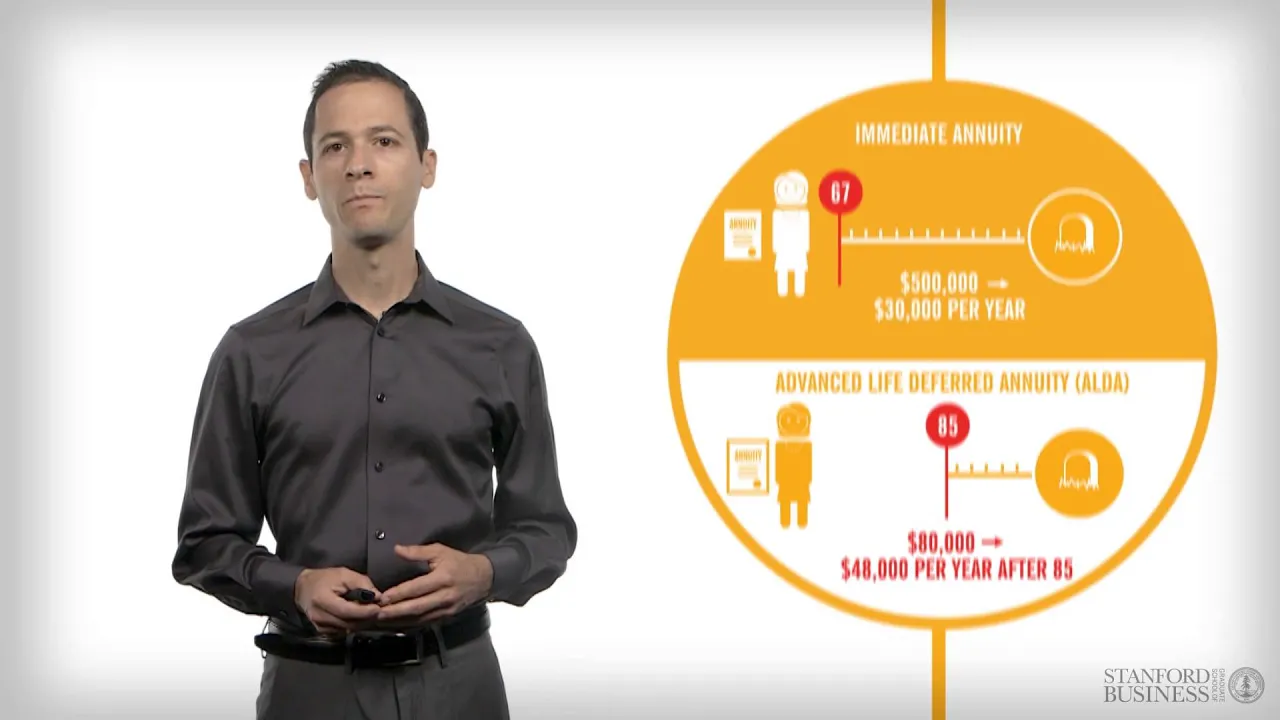

Q: How can an individual replicate a DB pension for their own retirement?

To replicate a DB pension, an individual could start by saving in a 401(k) plan and then purchasing an annuity from an insurance company upon retirement. However, the challenge lies in guaranteeing a specific level of monthly benefits, as it depends on the performance of risky assets in the 401(k) or interest rates at the time of retirement.

Q: What happens if the assets in a DB pension plan do not perform as expected?

For an individual saving in a 401(k) or similar plan, poor asset performance means adjusting their expected retirement lifestyle and consumption based on the available balance. However, if a DB pension plan, sponsored by an employer or taxpayer, invests in risky assets that underperform, the employer must still provide the guaranteed sum regardless. Scaling back employee pensions would be considered a violation of the contract between the employer and the employee, potentially leading to legal issues.

Q: How can shareholders be exposed to DB pension risk?

Although only 17% of private-sector employees participate in DB plans, many companies still carry legacy DB promises to older employees and retirees. If a firm faces a shortfall in the assets required to pay these pensions, the reduction must be funded from corporate profits, thereby impacting shareholder value.

Q: How can individuals ensure their best interests are represented in decision-making regarding DB pension contracts?

As someone who offers employees pension plans, either directly or as a taxpayer, it is crucial to understand the contractual obligations owed to every employee currently and in the future. Rather than assuming someone else will handle this responsibility, individuals should actively engage with their delegates, such as City Councils or state legislators, to ensure decisions align with their best interests.

Takeaways

Understanding defined benefit (DB) pensions is essential for both recipients and taxpayers, as they directly impact financial obligations and decision-making. While only a minority of private-sector employees participate in DB plans, many government employees and retirees rely on these pensions. Additionally, shareholders may be exposed to DB pension risk if a company struggles to meet its pension obligations. By comprehending the nature and implications of DB pensions, individuals can actively participate in discussions and decisions that affect their financial well-being and the well-being of others.

Share This Summary 📚

Explore More Summaries from Stanford Graduate School of Business 📚