Shifting Risk Mindsets, from Tech to Bio | Summary and Q&A

TL;DR

Biotech entrepreneurs face unique challenges in the bio space, including the need to translate new technologies, navigate complex regulations, secure funding, and balance the development of platforms and assets.

Key Insights

- 👾 Translation of innovative technologies is a significant challenge for biotech entrepreneurs in the bio space.

- 🤝 Early proof-of-concept deals are important to attract larger investments and partnerships.

- 🪛 The data-driven approach and efficient utilization of data are transforming biotech companies.

- 👨💼 Pilot projects can be risky but strategic business development and thoughtful value chain positioning can minimize this challenge.

- 🍉 Biotech companies need to balance the development of platforms and assets to capture value and long-term sustainability.

- 🐕🦺 The transition from service-based models to developing in-house assets is a common journey for biotech startups.

- ☣️ Reimbursement, regulatory, and scientific risks are specific challenges in diagnostics and other bio applications.

- 🧑💻 Biotech entrepreneurs should be selective in choosing investors based on their understanding of the company's goals and the ability to support scientific and tech-driven aspects.

Transcript

Read and summarize the transcript of this video on Glasp Reader (beta).

Questions & Answers

Q: What is the top challenge for entrepreneurs in the bio space regarding innovative technologies and building a company?

The top challenge is the need to translate new technologies to stakeholders who may not understand the unique language of the bio space, such as partners, funders, and the media. This requires effective communication and storytelling.

Q: How do biotech entrepreneurs navigate the high barriers to prove the efficacy of their technology?

Biotech entrepreneurs often secure early proof-of-concept deals to demonstrate the value and usefulness of their technology. These deals may be smaller in scale but can attract larger investments and partnerships in the future.

Q: What makes the data-driven approach in biotech different from previous computational techniques in drug discovery?

The availability of vast amounts of data is the key differentiator. Biotech companies are now considering themselves as data science companies, utilizing AI and machine learning techniques to efficiently use the data and derive valuable insights.

Q: How do early-stage companies in the bio space address the challenge of funding and managing pilot projects?

Early-stage companies often start with pilot projects as a service-based approach to generate cash flow and prove their technology. However, they need to carefully select partners and manage scope creep to ensure successful pilot projects that can lead to bigger deals.

Summary

In this video, a team of experts discusses the challenges faced by entrepreneurs in the bio space and how they differ from those in the tech industry. They highlight the importance of communicating effectively in a new language and translating new technologies to stakeholders. They also explore the pitfalls of starting with pilot projects and the need to be selective in choosing partners. The conversation delves into the role of data in the bio space and how it is transforming companies into data science companies. The experts also touch upon the challenges and opportunities in computational techniques and drug discovery. They discuss the importance of strategic business development deals and the need to balance the focus on developing assets with the platform itself. The conversation expands to include pitfalls in the diagnostic and biology sectors, such as reimbursement challenges and the importance of designing killer experiments. The experts also explore the intricacies of getting funded and finding the right investor base based on the specific stage and metrics of the business.

Questions & Answers

Q: What is the top issue that entrepreneurs in the bio space face when building a company?

The top issue for entrepreneurs in the bio space is speaking a new language and effectively translating new technologies to partners, funders, and the media. This is crucial as the bio space is different from the tech industry, requiring a different approach to communication.

Q: What distinguishes companies in the bio space?

Companies in the bio space often have to prove the usefulness and functionality of their technology, which can be a high bar to pass. Early proof-of-concept deals may seem impressive, but they tend to be easier to obtain. The real challenge lies in securing bigger deals that have a significant impact.

Q: What is exciting about the current trends in computational techniques and drug discovery?

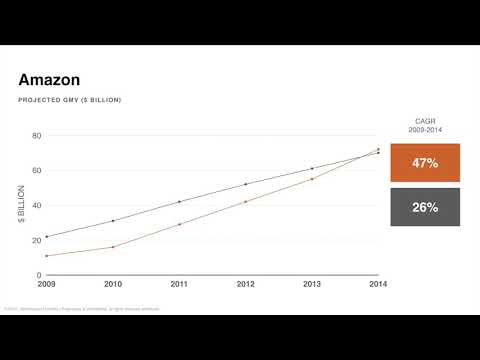

The use of AI and machine learning in drug discovery is often seen as exciting, but it is the abundance of data and its efficient utilization that truly makes a difference. Many companies in the pharma and biotech industries now consider themselves data science companies, highlighting a shift in mindset from traditional biotech approaches.

Q: What are the pitfalls of starting with pilot projects in the bio space?

Starting with pilot projects can be tempting, but it comes with several pitfalls. These projects are often relatively small upfront and may not provide enough cash flow to sustain the business. Additionally, working with large companies on pilot projects can lead to scope creep and extended timelines, making it challenging to deliver on multiple projects simultaneously.

Q: How can companies navigate the challenge of balancing a platform and their first successful asset?

It is important to avoid the temptation of focusing solely on the successful asset and neglecting the platform. By structuring business development deals strategically, companies can bridge the gap between the asset and the platform, capturing value from the larger partner while still ensuring opportunities for future development.

Q: What are the pitfalls in the diagnostics sector?

One of the major pitfalls in the diagnostics sector is overlooking reimbursements. Before designing a test, it is essential to have confidence in reimbursement possibilities. Considering the value that the test will add and the potential market demand is crucial to building a sustainable business.

Q: How can companies address reimbursements in diagnostics?

It is important to think about reimbursements at the earliest stages of building a diagnostics company. Understanding the value added by the test and identifying potential stakeholders who may be motivated to pay for the test, such as self-insured employers, can help address reimbursement challenges.

Q: How can companies navigate the different investor requirements in the bio space?

Companies in the bio space often fall into a combination of consumer, enterprise, and biotech categories. Each investor type has specific metrics they prioritize, such as user growth for consumer-focused companies or revenue for enterprise-focused companies. Companies should clearly define their metrics and choose investors based on their alignment with those metrics.

Q: How can companies balance the platform and asset focus to secure funding?

It is crucial to consider the near-term and long-term goals of the company. Early-stage companies may focus more on the platform and securing proof of concept for the technology. As the company matures, the focus can shift to developing assets while maintaining the strength of the platform. Finding investors who understand the balance and can support the company in the long term is key.

Q: What are the challenges of dealing with science risk in tech-focused or hybrid biotech companies?

Tech investors are often not equipped to handle science risk, which is a challenge for tech-focused or hybrid biotech companies. It is important for these companies to build a diverse investor syndicate that includes both traditional bio investors and tech investors who understand and support the unique challenges and progress metrics of the company.

Q: How should companies approach getting funded in the bio space?

Companies should have a clear understanding of their metrics and milestones and select investors who align with those goals. It is important to consider the stage and nature of the business, whether it leans more towards tech, biotech, or a combination. Building a syndicate with a mix of investors can also provide diverse support and understanding.

Takeaways

Entrepreneurs in the bio space face the challenge of translating new technologies into a language that stakeholders can understand. Startups should be selective in choosing partners and avoid getting trapped in a cycle of pilot projects. The value of data in the bio space cannot be underestimated, as it transforms companies into data science companies. Navigating the challenges of reimbursements in the diagnostics sector requires a clear understanding of market demand and the value-added by the test. Balancing the focus on the platform and assets is crucial to success, as is understanding investor requirements and aligning with the right investor base. Companies should design killer experiments and address science risk with a diverse investor syndicate that supports both tech and bio aspects of the business.

Summary & Key Takeaways

-

Biotech entrepreneurs often struggle to translate their new technologies to stakeholders like partners, funders, and the media, as they speak a different language geared towards a tech audience.

-

Companies in the bio space have high barriers to prove the efficacy of their technology and need to secure early proof-of-concept deals to attract larger investments and partnerships.

-

The data-driven approach in biotech is shifting the mindset from being solely a biotech company to a data science company, with more focus on efficient data usage.

Share This Summary 📚

Explore More Summaries from a16z 📚