A History of the Theory of Investments: My Annotated Bibliography

By Mark Rubinstein

Category

InvestingRecommended by

"A History of the Theory of Investments" by Mark Rubinstein provides a comprehensive overview of the evolution and development of investment theory over time.

The book delves into the historical roots of investments, beginning with the ancient Mesopotamian civilization and the fundamentals of risk management they employed. It then proceeds to explore the contributions of prominent thinkers such as Aristotle and early Islamic scholars, who laid the foundation for understanding investment principles.

Rubinstein analyzes the significant advancements made during the Renaissance, including the emergence of capital markets and the influential contributions of mathematicians and economists such as Leonardo Fibonacci and Isaac Newton.

Moving into the modern era, he dissects the impact of the Industrial Revolution and the growing influence of financial institutions. Rubinstein explores seminal works like "The Theory of Investment Value" by John Burr Williams, which revolutionized investment analysis.

The book also delves into the rise of academic research in the field, examining the contributions of renowned economists and Nobel laureates, including Harry Markowitz, William Sharpe, and Eugene Fama.

Throughout the book, Rubinstein emphasizes the evolution of investment theory in response to real-world events, such as the Great Depression, the dot-com bubble, and the financial crisis of 2008, showcasing the practical applications of these theories.

Drawing on a wealth of scholarly sources, Rubinstein provides readers with a succinct, yet comprehensive, history of investment theory. "A History of the Theory of Investments" serves as an indispensable resource for finance professionals, academics, and anyone interested in understanding the development and evolution of investment principles over time.

The book delves into the historical roots of investments, beginning with the ancient Mesopotamian civilization and the fundamentals of risk management they employed. It then proceeds to explore the contributions of prominent thinkers such as Aristotle and early Islamic scholars, who laid the foundation for understanding investment principles.

Rubinstein analyzes the significant advancements made during the Renaissance, including the emergence of capital markets and the influential contributions of mathematicians and economists such as Leonardo Fibonacci and Isaac Newton.

Moving into the modern era, he dissects the impact of the Industrial Revolution and the growing influence of financial institutions. Rubinstein explores seminal works like "The Theory of Investment Value" by John Burr Williams, which revolutionized investment analysis.

The book also delves into the rise of academic research in the field, examining the contributions of renowned economists and Nobel laureates, including Harry Markowitz, William Sharpe, and Eugene Fama.

Throughout the book, Rubinstein emphasizes the evolution of investment theory in response to real-world events, such as the Great Depression, the dot-com bubble, and the financial crisis of 2008, showcasing the practical applications of these theories.

Drawing on a wealth of scholarly sources, Rubinstein provides readers with a succinct, yet comprehensive, history of investment theory. "A History of the Theory of Investments" serves as an indispensable resource for finance professionals, academics, and anyone interested in understanding the development and evolution of investment principles over time.

Share This Book 📚

More Books in Investing

Poor Charlie's Almanack

Charlie Munger

Antifragile

Nassim Nicholas Taleb

Skin In The Game

Nassim Taleb

Thinking In Bets

Annie Duke

Security Analysis

Benjamin Graham

The Dao of Capital

Mark Spitznagel

The Intelligent Investor

Benjamin Graham

The Psychology of Money

Morgan Housel

When Genius Failed

Roger Lowenstein

Bitcoin Billionaires

Ben Mezrich

Secrets of Sand Hill Road

Scott Kupor

The Black Swan

Nassim Taleb

The Most Important Thing

Howard Marks

The Success Equation

Michael Mauboussin

Charlie Munger

Tren Griffin

Expectations Investing

Michael Mauboussin

Fooling Some of the People All of the Time

David Einhorn

Layered Money

Nik Bhatia

Manias, Panics, and Crashes

Robert Aliber

Market Wizards

Jack Schwager

Mastering The Market Cycle

Howard Marks

Money

Tony Robbins

More Than You Know

Michael Mauboussin

Reminiscences of a Stock Operator

Edwin Lefevre

Stress Test

Timothy Geithner

The (Mis)Behavior of Markets

Benoit Mandelbrot

The Alchemy of Finance

George Soros

The Essays of Warren Buffett

Lawrence Cunningham & Warren Buffett

The Most Important Thing Illuminated

Howard Marks

The Tao of Charlie Munger

David Clark

Popular Books Recommended by Great Minds 📚

Thinking In Bets

Annie Duke

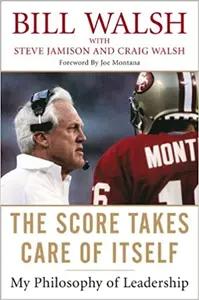

The Score Takes Care of Itself

Bill Walsh

The Lord of the Rings

J.R.R. Tolkien

Billion Dollar Whale

Tom Wright

The Innovators Dilemma

Clayton Christensen

Surely You're Joking Mr. Feynman

Richard Feynman

Good To Great

Jim Collins

Sapiens

Yuval Noah Harari

The Ascent of Money

Niall Ferguson

The Psychology of Money

Morgan Housel

Poor Charlie's Almanack

Charlie Munger

Zero to One

Peter Thiel

Influence

Robert Cialdini

Siddhartha

Hermann Hesse

The Moment of Lift

Melinda Gates

Homo Deus

Yuval Noah Harari

The Rational Optimist

Matt Ridley

The Hard Thing About Hard Things

Ben Horowitz

High Growth Handbook

Elad Gil

The Outsiders

William Thorndike

Crossing the Chasm

Geoffrey Moore

Creativity, Inc.

Ed Catmull

Security Analysis

Benjamin Graham

The Three Body Problem

Cixin Liu

Scale

Geoffrey West

The Fountainhead

Ayn Rand

The Power of Habit

Charles Duhigg

The Internet of Money Volume 1

Andreas Antonopolous

Trailblazer

Marc Benioff

Range

David Epstein