Mastering The Market Cycle: Getting the Odds on Your Side

By Howard Marks

Category

InvestingRecommended by

In "Mastering The Market Cycle," Howard Marks, a renowned investor, draws upon his experiences and expertise to provide readers with valuable insights into understanding and navigating the complex world of market cycles. Marks emphasizes the importance of recognizing and interpreting the patterns and behavior of market cycles for successful investing.

The book explores various factors and indicators that influence market cycles, such as investor psychology, economic trends, and market valuations. Marks explains how these factors can drive market cycles and cause fluctuations in asset prices. He emphasizes the significance of market inefficiencies and the potential opportunities they present for astute investors.

Marks also delves into the crucial role of risk management and the need to balance risk and potential reward. He provides practical advice on how to identify market extremes and apply a disciplined approach to avoid excessive optimism during upswings or succumbing to fear during downturns.

Drawing upon his immensely successful career, Marks shares his experiences and lessons learned from previous market cycles. Through engaging anecdotes and case studies, he illustrates the importance of patience, contrarian thinking, and developing an independent perspective to thrive in the ever-changing investment landscape.

"Mastering The Market Cycle" acts as a comprehensive guide for investors seeking to navigate the treacherous waters of market cycles. Marks emphasizes the importance of being well-informed, adaptable, and disciplined to maximize investment returns and minimize potential losses. This insightful book serves as an indispensable resource for both seasoned professionals and novice investors in their quest to master the intricacies of market cycles and achieve long-term investment success.

The book explores various factors and indicators that influence market cycles, such as investor psychology, economic trends, and market valuations. Marks explains how these factors can drive market cycles and cause fluctuations in asset prices. He emphasizes the significance of market inefficiencies and the potential opportunities they present for astute investors.

Marks also delves into the crucial role of risk management and the need to balance risk and potential reward. He provides practical advice on how to identify market extremes and apply a disciplined approach to avoid excessive optimism during upswings or succumbing to fear during downturns.

Drawing upon his immensely successful career, Marks shares his experiences and lessons learned from previous market cycles. Through engaging anecdotes and case studies, he illustrates the importance of patience, contrarian thinking, and developing an independent perspective to thrive in the ever-changing investment landscape.

"Mastering The Market Cycle" acts as a comprehensive guide for investors seeking to navigate the treacherous waters of market cycles. Marks emphasizes the importance of being well-informed, adaptable, and disciplined to maximize investment returns and minimize potential losses. This insightful book serves as an indispensable resource for both seasoned professionals and novice investors in their quest to master the intricacies of market cycles and achieve long-term investment success.

Share This Book 📚

More Books in Investing

Poor Charlie's Almanack

Charlie Munger

Antifragile

Nassim Nicholas Taleb

Skin In The Game

Nassim Taleb

Thinking In Bets

Annie Duke

Security Analysis

Benjamin Graham

The Dao of Capital

Mark Spitznagel

The Intelligent Investor

Benjamin Graham

The Psychology of Money

Morgan Housel

When Genius Failed

Roger Lowenstein

Bitcoin Billionaires

Ben Mezrich

Secrets of Sand Hill Road

Scott Kupor

The Black Swan

Nassim Taleb

The Most Important Thing

Howard Marks

The Success Equation

Michael Mauboussin

Charlie Munger

Tren Griffin

Expectations Investing

Michael Mauboussin

Fooling Some of the People All of the Time

David Einhorn

Layered Money

Nik Bhatia

Manias, Panics, and Crashes

Robert Aliber

Market Wizards

Jack Schwager

Mastering The Market Cycle

Howard Marks

Money

Tony Robbins

More Than You Know

Michael Mauboussin

Reminiscences of a Stock Operator

Edwin Lefevre

Stress Test

Timothy Geithner

The (Mis)Behavior of Markets

Benoit Mandelbrot

The Alchemy of Finance

George Soros

The Essays of Warren Buffett

Lawrence Cunningham & Warren Buffett

The Most Important Thing Illuminated

Howard Marks

The Tao of Charlie Munger

David Clark

Popular Books Recommended by Great Minds 📚

The Fountainhead

Ayn Rand

The Prince

Nicolo Machiavelli

Measure What Matters

John Doerr

Zero to One

Peter Thiel

Surely You're Joking Mr. Feynman

Richard Feynman

The Dao of Capital

Mark Spitznagel

The Intelligent Investor

Benjamin Graham

The Third Wave

Steve Case

Becoming Steve Jobs

Brent Schlender

1984

George Orwell

Thinking, Fast and Slow

Daniel Kahneman

The Ascent of Money

Niall Ferguson

The Ride of a Lifetime

Bob Iger

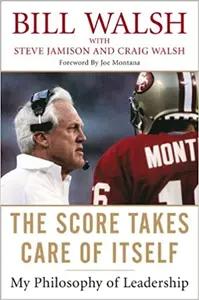

The Score Takes Care of Itself

Bill Walsh

Thinking In Bets

Annie Duke

The Three Body Problem

Cixin Liu

When Breath Becomes Air

Paul Kalanithi

Poor Charlie's Almanack

Charlie Munger

American Kingpin

Nick Bilton

Good To Great

Jim Collins

Loonshots

Safi Bahcall

The Holy Bible

Various

Masters of Doom

David Kushner

The Undoing Project

Michael Lewis

Guns, Germs, and Steel

Jared Diamond

Give and Take

Adam Grant

The Lean Startup

Eric Reis

The Great CEO Within

Matt Mochary

Dune

Frank Herbert

Shoe Dog

Phil Knight