Adaptive Markets: Financial Evolution at the Speed of Thought

By Andrew Lo

Category

EconomicsRecommended by

"Adaptive Markets" by Andrew Lo explores the principles of modern finance using insights from evolutionary biology, neuroscience, and artificial intelligence. Lo argues that traditional theories of market efficiency fall short in explaining market behavior and proposes an alternative framework rooted in the concept of adaptive markets.

The book begins by examining the flaws of the efficient market hypothesis and the limits of rational decision making in financial markets. Lo introduces the concept of the adaptive market hypothesis, which suggests that market participants adapt their behavior based on changing circumstances, leading to the emergence of patterns and market inefficiencies.

Drawing from various fields of study, Lo delves into the evolutionary foundations of financial markets and shows how natural selection has shaped behaviors and traits observed in market participants. He highlights the significance of genetic and neural influences, emphasizing the role they play in risk-taking, individual decision making, and the overall dynamics of markets.

In addition, Lo explores how advances in technology and the rise of machines have impacted financial markets. He discusses the benefits and risks associated with algorithmic trading, artificial intelligence, and big data analytics, urging for a careful balance between human judgement and automated decision-making systems.

The book concludes with practical recommendations for investors and regulators to navigate the complexities of adaptive markets. Lo highlights the importance of continuously learning and adapting to market conditions, while also advocating for the need to design regulatory policies that promote market stability and resilience.

Overall, "Adaptive Markets" provides a groundbreaking perspective on the nature of financial markets, shedding light on the interactions between biology, psychology, and economics. Lo's interdisciplinary approach offers a fresh understanding of market dynamics and presents valuable insights for both professionals and individuals seeking a deeper understanding of the modern financial landscape.

The book begins by examining the flaws of the efficient market hypothesis and the limits of rational decision making in financial markets. Lo introduces the concept of the adaptive market hypothesis, which suggests that market participants adapt their behavior based on changing circumstances, leading to the emergence of patterns and market inefficiencies.

Drawing from various fields of study, Lo delves into the evolutionary foundations of financial markets and shows how natural selection has shaped behaviors and traits observed in market participants. He highlights the significance of genetic and neural influences, emphasizing the role they play in risk-taking, individual decision making, and the overall dynamics of markets.

In addition, Lo explores how advances in technology and the rise of machines have impacted financial markets. He discusses the benefits and risks associated with algorithmic trading, artificial intelligence, and big data analytics, urging for a careful balance between human judgement and automated decision-making systems.

The book concludes with practical recommendations for investors and regulators to navigate the complexities of adaptive markets. Lo highlights the importance of continuously learning and adapting to market conditions, while also advocating for the need to design regulatory policies that promote market stability and resilience.

Overall, "Adaptive Markets" provides a groundbreaking perspective on the nature of financial markets, shedding light on the interactions between biology, psychology, and economics. Lo's interdisciplinary approach offers a fresh understanding of market dynamics and presents valuable insights for both professionals and individuals seeking a deeper understanding of the modern financial landscape.

Share This Book 📚

More Books in Economics

Principles for Dealing With The Changing World Order

Ray Dalio

The Rational Optimist

Matt Ridley

The Bitcoin Standard

Saifedean Ammous

Economics in One Lesson

Henry Hazlitt

The Ascent of Money

Niall Ferguson

Enlightenment Now

Steven Pinker

The Rise of the Rest

Steve Case

The Road to Serfdom

F.A. Hayek

The Wealth of Nations

Adam Smith

Capital In The 21st Century

Thomas Piketty

Check Your Financial Privilege

Alex Gladstein

Dealing with China

Henry Paulson

Debt

David Graeber

Human Action

Ludwig Von Mises

The Future of Capitalism

Paul Collier

The Prize

Daniel Yergin

The Wealth and Poverty of Nations

David Landes

Thinking In Systems

Donella H. Meadows

Trade Is Not A Four Letter Word

Fred Hochberg

Why Nations Fail

Daron Acemoglu

A Great Leap Forward?

John Mauldin & Worth Wray

A Guide To Econometrics

Peter E. Kennedy

Adaptive Markets

Andrew Lo

Age Of Ambition

Evan Osnos

An Apology for the Builder

Nicholas Barbon

Broken Money

Lyn Alden

Bureaucracy

Ludwig Von Mises

Capitalism Without Capital

Jonathan Haskel & Stian Westlake

Central Banking 101

Joseph Wang

Complexity and the Economy

W. Brian Arthur

Popular Books Recommended by Great Minds 📚

Surely You're Joking Mr. Feynman

Richard Feynman

The Rational Optimist

Matt Ridley

Homo Deus

Yuval Noah Harari

The Ascent of Money

Niall Ferguson

Lying

Sam Harris

Blitzscaling

Reid Hoffman

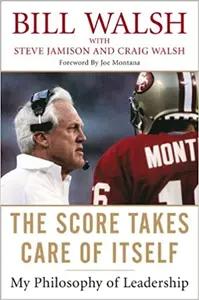

The Score Takes Care of Itself

Bill Walsh

The Power of Habit

Charles Duhigg

The Bitcoin Standard

Saifedean Ammous

The Internet of Money Volume 1

Andreas Antonopolous

The Hard Thing About Hard Things

Ben Horowitz

Crossing the Chasm

Geoffrey Moore

The Great CEO Within

Matt Mochary

Bad Blood

John Carreyrou

Good To Great

Jim Collins

Guns, Germs, and Steel

Jared Diamond

Principles

Ray Dalio

Can't Hurt Me

David Goggins

The Sovereign Individual

James Dale Davidson & William Rees-Mogg

Sapiens

Yuval Noah Harari

Economics in One Lesson

Henry Hazlitt

The Outsiders

William Thorndike

The True Believer

Eric Hoffer

American Kingpin

Nick Bilton

Principles for Dealing With The Changing World Order

Ray Dalio

Brotopia

Emily Chang

Why We Sleep

Matthew Walker

Zero to One

Peter Thiel

Shoe Dog

Phil Knight

The Three Body Problem

Cixin Liu