Capital Ideas: The Improbable Origins of Modern Wall Street

By Peter Bernstein

Category

InvestingRecommended by

"Capital Ideas" by Peter Bernstein is a groundbreaking exploration of the evolution and impact of modern finance theories.

In this concise and enlightening book, Bernstein delves into the ideas that have shaped the world of investing and transformed the way we view financial markets. Starting with the revolutionary contributions of Harry Markowitz, William Sharpe, and Merton Miller, Bernstein traces the emergence of modern portfolio theory and the capital asset pricing model.

As Bernstein navigates the intricacies of these concepts, he also unveils the role of behavioral finance in shaping investment behaviors and the challenges of applying quantitative models in a volatile market. Delving into the infamous Long-Term Capital Management (LTCM) debacle, Bernstein offers valuable lessons on the limitations of financial models and the perils of excessive risk-taking.

Moreover, Bernstein highlights the contributions of pioneering investors like Benjamin Graham and Warren Buffett, whose fundamental analysis and value investing strategies have stood the test of time. Drawing on historical examples and vivid anecdotes, "Capital Ideas" provides deep insights into the ideas that drive financial markets and the people behind them.

Ultimately, "Capital Ideas" is a captivating journey through the history of finance, shedding light on the intellectual revolutions that have shaped the way we invest and manage risk. Bernstein's clear and concise writing style makes complex financial concepts accessible to both professionals and lay readers, enriching their understanding of the dynamic world of investing.

In this concise and enlightening book, Bernstein delves into the ideas that have shaped the world of investing and transformed the way we view financial markets. Starting with the revolutionary contributions of Harry Markowitz, William Sharpe, and Merton Miller, Bernstein traces the emergence of modern portfolio theory and the capital asset pricing model.

As Bernstein navigates the intricacies of these concepts, he also unveils the role of behavioral finance in shaping investment behaviors and the challenges of applying quantitative models in a volatile market. Delving into the infamous Long-Term Capital Management (LTCM) debacle, Bernstein offers valuable lessons on the limitations of financial models and the perils of excessive risk-taking.

Moreover, Bernstein highlights the contributions of pioneering investors like Benjamin Graham and Warren Buffett, whose fundamental analysis and value investing strategies have stood the test of time. Drawing on historical examples and vivid anecdotes, "Capital Ideas" provides deep insights into the ideas that drive financial markets and the people behind them.

Ultimately, "Capital Ideas" is a captivating journey through the history of finance, shedding light on the intellectual revolutions that have shaped the way we invest and manage risk. Bernstein's clear and concise writing style makes complex financial concepts accessible to both professionals and lay readers, enriching their understanding of the dynamic world of investing.

Share This Book 📚

More Books in Investing

Poor Charlie's Almanack

Charlie Munger

Antifragile

Nassim Nicholas Taleb

Skin In The Game

Nassim Taleb

Thinking In Bets

Annie Duke

Security Analysis

Benjamin Graham

The Dao of Capital

Mark Spitznagel

The Intelligent Investor

Benjamin Graham

The Psychology of Money

Morgan Housel

When Genius Failed

Roger Lowenstein

Bitcoin Billionaires

Ben Mezrich

Secrets of Sand Hill Road

Scott Kupor

The Black Swan

Nassim Taleb

The Most Important Thing

Howard Marks

The Success Equation

Michael Mauboussin

Charlie Munger

Tren Griffin

Expectations Investing

Michael Mauboussin

Fooling Some of the People All of the Time

David Einhorn

Layered Money

Nik Bhatia

Manias, Panics, and Crashes

Robert Aliber

Market Wizards

Jack Schwager

Mastering The Market Cycle

Howard Marks

Money

Tony Robbins

More Than You Know

Michael Mauboussin

Reminiscences of a Stock Operator

Edwin Lefevre

Stress Test

Timothy Geithner

The (Mis)Behavior of Markets

Benoit Mandelbrot

The Alchemy of Finance

George Soros

The Essays of Warren Buffett

Lawrence Cunningham & Warren Buffett

The Most Important Thing Illuminated

Howard Marks

The Tao of Charlie Munger

David Clark

Popular Books Recommended by Great Minds 📚

The Checklist Manifesto

Atul Gawande

The Fountainhead

Ayn Rand

How to Change Your Mind

Michael Pollan

Skin In The Game

Nassim Taleb

Against The Gods

Peter Bernstein

Principles for Dealing With The Changing World Order

Ray Dalio

The Lessons of History

Will & Ariel Durant

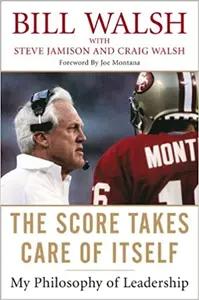

The Score Takes Care of Itself

Bill Walsh

Brotopia

Emily Chang

Thinking In Bets

Annie Duke

Superforecasting

Philip Tetlock

The Dao of Capital

Mark Spitznagel

Wanting

Luke Burgis

Thinking, Fast and Slow

Daniel Kahneman

The Lord of the Rings

J.R.R. Tolkien

The Hard Thing About Hard Things

Ben Horowitz

Behave

Robert Sapolsky

Man's Search for Meaning

Viktor Frankl

1984

George Orwell

The Rational Optimist

Matt Ridley

Economics in One Lesson

Henry Hazlitt

Give and Take

Adam Grant

Homo Deus

Yuval Noah Harari

Behind the Cloud

Marc Benioff

American Kingpin

Nick Bilton

Only the Paranoid Survive

Andy Grove

Who We Are and How We Got Here

David Reich

The Psychology of Money

Morgan Housel

The Ascent of Money

Niall Ferguson

7 Powers

Hamilton Helmer