Contrarian Investment Strategies

By David Dreman

Category

InvestingRecommended by

Contrarian Investment Strategies by David Dreman is a comprehensive guide that challenges traditional investment wisdom and offers readers an alternative approach to maximizing returns in the stock market.

Dreman sets out to debunk popular investment theories and urges investors to steer clear of conventional wisdom, arguing that following the crowd can lead to poor investment decisions. Instead, Dreman advocates for a contrarian strategy that seeks out undervalued stocks and takes advantage of market inefficiencies.

The book provides a step-by-step framework for implementing a contrarian approach, starting with the identification of investment opportunities through in-depth analysis of specific sectors, industries, and individual companies. Dreman emphasizes the importance of conducting thorough research and analysis to uncover undervalued stocks that are often overlooked by the majority of investors focused solely on popular and trendy choices.

Contrarian Investment Strategies also covers behavioral finance and the impact of investor psychology on stock prices. Dreman explores common biases and irrational behaviors that influence market participants, offering valuable insights into how to capitalize on these psychological tendencies.

Moreover, the book includes practical advice on building a contrarian portfolio, managing risk, and applying disciplined investment principles. Dreman stresses the importance of diversification and maintaining a long-term perspective, even when faced with short-term market fluctuations.

Overall, Contrarian Investment Strategies provides readers with a comprehensive understanding of contrarian investing and equips them with the tools and knowledge needed to implement this investment strategy successfully. Dreman's expertise and experience make this book an invaluable resource for both novice and experienced investors looking to achieve superior returns in the stock market.

Dreman sets out to debunk popular investment theories and urges investors to steer clear of conventional wisdom, arguing that following the crowd can lead to poor investment decisions. Instead, Dreman advocates for a contrarian strategy that seeks out undervalued stocks and takes advantage of market inefficiencies.

The book provides a step-by-step framework for implementing a contrarian approach, starting with the identification of investment opportunities through in-depth analysis of specific sectors, industries, and individual companies. Dreman emphasizes the importance of conducting thorough research and analysis to uncover undervalued stocks that are often overlooked by the majority of investors focused solely on popular and trendy choices.

Contrarian Investment Strategies also covers behavioral finance and the impact of investor psychology on stock prices. Dreman explores common biases and irrational behaviors that influence market participants, offering valuable insights into how to capitalize on these psychological tendencies.

Moreover, the book includes practical advice on building a contrarian portfolio, managing risk, and applying disciplined investment principles. Dreman stresses the importance of diversification and maintaining a long-term perspective, even when faced with short-term market fluctuations.

Overall, Contrarian Investment Strategies provides readers with a comprehensive understanding of contrarian investing and equips them with the tools and knowledge needed to implement this investment strategy successfully. Dreman's expertise and experience make this book an invaluable resource for both novice and experienced investors looking to achieve superior returns in the stock market.

Share This Book 📚

More Books in Investing

Poor Charlie's Almanack

Charlie Munger

Antifragile

Nassim Nicholas Taleb

Skin In The Game

Nassim Taleb

Thinking In Bets

Annie Duke

Security Analysis

Benjamin Graham

The Dao of Capital

Mark Spitznagel

The Intelligent Investor

Benjamin Graham

The Psychology of Money

Morgan Housel

When Genius Failed

Roger Lowenstein

Bitcoin Billionaires

Ben Mezrich

Secrets of Sand Hill Road

Scott Kupor

The Black Swan

Nassim Taleb

The Most Important Thing

Howard Marks

The Success Equation

Michael Mauboussin

Charlie Munger

Tren Griffin

Expectations Investing

Michael Mauboussin

Fooling Some of the People All of the Time

David Einhorn

Layered Money

Nik Bhatia

Manias, Panics, and Crashes

Robert Aliber

Market Wizards

Jack Schwager

Mastering The Market Cycle

Howard Marks

Money

Tony Robbins

More Than You Know

Michael Mauboussin

Reminiscences of a Stock Operator

Edwin Lefevre

Stress Test

Timothy Geithner

The (Mis)Behavior of Markets

Benoit Mandelbrot

The Alchemy of Finance

George Soros

The Essays of Warren Buffett

Lawrence Cunningham & Warren Buffett

The Most Important Thing Illuminated

Howard Marks

The Tao of Charlie Munger

David Clark

Popular Books Recommended by Great Minds 📚

Principles

Ray Dalio

Mindset

Carol Dweck

The Almanack of Naval Ravikant

Eric Jorgenson

Sapiens

Yuval Noah Harari

The Autobiography of Benjamin Franklin

Benjamin Franklin

Titan

Ron Chernow

Masters of Doom

David Kushner

The Ride of a Lifetime

Bob Iger

Foundation

Isaac Asimov

Trailblazer

Marc Benioff

The Internet of Money Volume 1

Andreas Antonopolous

The Hitchhikers Guide to the Galaxy

Douglas Adams

The Sovereign Individual

James Dale Davidson & William Rees-Mogg

Destined For War

Graham Allison

Homo Deus

Yuval Noah Harari

Who We Are and How We Got Here

David Reich

Influence

Robert Cialdini

High Output Management

Andrew Grove

Can't Hurt Me

David Goggins

The Outsiders

William Thorndike

1984

George Orwell

The Lean Startup

Eric Reis

Blitzscaling

Reid Hoffman

The Network State

Balaji Srinivasan

Skin In The Game

Nassim Taleb

Billion Dollar Whale

Tom Wright

The Power of Habit

Charles Duhigg

The Dao of Capital

Mark Spitznagel

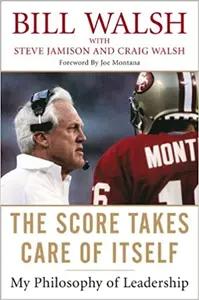

The Score Takes Care of Itself

Bill Walsh

The Hard Thing About Hard Things

Ben Horowitz