Quality of Earnings

By Thornton O'Glove

Category

InvestingRecommended by

"Quality of Earnings" by Thornton O'Glove offers a comprehensive exploration of the crucial concept of financial analysis. With a focus on assessing the reliability and accuracy of a company's earnings, O'Glove presents insightful techniques and strategies to help investors make informed decisions.

The book delves into the significance of scrutinizing income statements and balance sheets, emphasizing the need to identify warning signs that could potentially reveal earnings manipulation or financial irregularities. O'Glove provides practical guidance for investors to navigate through financial reports, decipher complex accounting practices, and identify tangible quality measures.

Through a systematic approach, O'Glove presents readers with various tools and methodologies to assess the sustainability and effectiveness of a company's earnings. He explores key metrics and ratios that shed light on the reliability of reported profits, providing readers with the necessary knowledge to differentiate between genuine growth and potential red flags.

O'Glove's insightful analysis extends beyond financial statements as he discusses the importance of understanding a company's business model, industry dynamics, and management quality. By incorporating qualitative factors alongside quantitative analysis, investors gain a more comprehensive understanding of a company's overall financial health.

Backed by abundant real-life case studies and examples, "Quality of Earnings" equips investors with the necessary skills and expertise to evaluate the quality and reliability of a company's earnings. O'Glove's accessible writing style and systematic framework make this book an invaluable resource for both novice and experienced investors.

Overall, "Quality of Earnings" provides a concise and specialized guide that empowers investors to make sound investment decisions by accurately assessing a company's financial performance and the quality of its earnings.

The book delves into the significance of scrutinizing income statements and balance sheets, emphasizing the need to identify warning signs that could potentially reveal earnings manipulation or financial irregularities. O'Glove provides practical guidance for investors to navigate through financial reports, decipher complex accounting practices, and identify tangible quality measures.

Through a systematic approach, O'Glove presents readers with various tools and methodologies to assess the sustainability and effectiveness of a company's earnings. He explores key metrics and ratios that shed light on the reliability of reported profits, providing readers with the necessary knowledge to differentiate between genuine growth and potential red flags.

O'Glove's insightful analysis extends beyond financial statements as he discusses the importance of understanding a company's business model, industry dynamics, and management quality. By incorporating qualitative factors alongside quantitative analysis, investors gain a more comprehensive understanding of a company's overall financial health.

Backed by abundant real-life case studies and examples, "Quality of Earnings" equips investors with the necessary skills and expertise to evaluate the quality and reliability of a company's earnings. O'Glove's accessible writing style and systematic framework make this book an invaluable resource for both novice and experienced investors.

Overall, "Quality of Earnings" provides a concise and specialized guide that empowers investors to make sound investment decisions by accurately assessing a company's financial performance and the quality of its earnings.

Share This Book 📚

More Books in Investing

Poor Charlie's Almanack

Charlie Munger

Antifragile

Nassim Nicholas Taleb

Skin In The Game

Nassim Taleb

Thinking In Bets

Annie Duke

Security Analysis

Benjamin Graham

The Dao of Capital

Mark Spitznagel

The Intelligent Investor

Benjamin Graham

The Psychology of Money

Morgan Housel

When Genius Failed

Roger Lowenstein

Bitcoin Billionaires

Ben Mezrich

Secrets of Sand Hill Road

Scott Kupor

The Black Swan

Nassim Taleb

The Most Important Thing

Howard Marks

The Success Equation

Michael Mauboussin

Charlie Munger

Tren Griffin

Expectations Investing

Michael Mauboussin

Fooling Some of the People All of the Time

David Einhorn

Layered Money

Nik Bhatia

Manias, Panics, and Crashes

Robert Aliber

Market Wizards

Jack Schwager

Mastering The Market Cycle

Howard Marks

Money

Tony Robbins

More Than You Know

Michael Mauboussin

Reminiscences of a Stock Operator

Edwin Lefevre

Stress Test

Timothy Geithner

The (Mis)Behavior of Markets

Benoit Mandelbrot

The Alchemy of Finance

George Soros

The Essays of Warren Buffett

Lawrence Cunningham & Warren Buffett

The Most Important Thing Illuminated

Howard Marks

The Tao of Charlie Munger

David Clark

Popular Books Recommended by Great Minds 📚

Destined For War

Graham Allison

The Lord of the Rings

J.R.R. Tolkien

The Third Wave

Steve Case

The Fountainhead

Ayn Rand

Extreme Ownership

Jocko Willink

The Outsiders

William Thorndike

The Great CEO Within

Matt Mochary

The Network State

Balaji Srinivasan

Originals

Adam Grant

Homo Deus

Yuval Noah Harari

The Intelligent Investor

Benjamin Graham

The Lean Startup

Eric Reis

Loonshots

Safi Bahcall

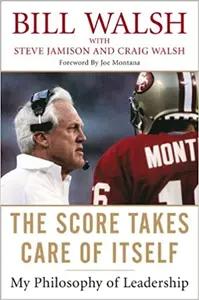

The Score Takes Care of Itself

Bill Walsh

The Rational Optimist

Matt Ridley

The Bitcoin Standard

Saifedean Ammous

Good To Great

Jim Collins

Meditations

Marcus Aurelius

Atlas Shrugged

Ayn Rand

The True Believer

Eric Hoffer

The Dao of Capital

Mark Spitznagel

Against The Gods

Peter Bernstein

The Rise And Fall Of American Growth

Robert J. Gordon

Can't Hurt Me

David Goggins

American Kingpin

Nick Bilton

Brotopia

Emily Chang

Crossing the Chasm

Geoffrey Moore

Einstein

Walter Isaacson

Surely You're Joking Mr. Feynman

Richard Feynman

Shoe Dog

Phil Knight