Rational Expectations: Asset Allocation for Investing Adults

By William Bernstein

Category

InvestingRecommended by

"Rational Expectations" by William Bernstein is a thought-provoking book that challenges traditional views on investing and presents a new approach based on rational expectations. In this concise and precise synopsis, Bernstein explores the inherent flaws of emotional decision-making in financial matters and demonstrates how rational expectations can lead to more successful investment outcomes.

The book begins by addressing the psychological biases that often cloud our judgment when it comes to financial decisions, emphasizing the need to overcome these biases through objective thinking. Bernstein argues that by adopting rational expectations, investors can make better-informed choices, mitigate risks, and potentially achieve more favorable outcomes.

Throughout the book, Bernstein provides practical examples and insightful analysis to support his arguments. He examines various asset classes, including stocks, bonds, and real estate, delving into the implications of rational expectations for each. The author also emphasizes the importance of diversification and asset allocation in achieving long-term investment goals.

Furthermore, "Rational Expectations" explores the impact of economic and market conditions on investment strategies. Bernstein discusses the relationship between inflation, interest rates, and asset prices, guiding readers on how to adjust their expectations accordingly. He also examines market efficiency, highlighting its limitations and proposing alternative investment approaches.

In conclusion, "Rational Expectations" is a concise and insightful book that challenges traditional investment beliefs and offers a new perspective. Through the lens of rational expectations, William Bernstein guides readers towards more rational decision-making, empowering them to navigate the complexities of investing with clarity and confidence.

The book begins by addressing the psychological biases that often cloud our judgment when it comes to financial decisions, emphasizing the need to overcome these biases through objective thinking. Bernstein argues that by adopting rational expectations, investors can make better-informed choices, mitigate risks, and potentially achieve more favorable outcomes.

Throughout the book, Bernstein provides practical examples and insightful analysis to support his arguments. He examines various asset classes, including stocks, bonds, and real estate, delving into the implications of rational expectations for each. The author also emphasizes the importance of diversification and asset allocation in achieving long-term investment goals.

Furthermore, "Rational Expectations" explores the impact of economic and market conditions on investment strategies. Bernstein discusses the relationship between inflation, interest rates, and asset prices, guiding readers on how to adjust their expectations accordingly. He also examines market efficiency, highlighting its limitations and proposing alternative investment approaches.

In conclusion, "Rational Expectations" is a concise and insightful book that challenges traditional investment beliefs and offers a new perspective. Through the lens of rational expectations, William Bernstein guides readers towards more rational decision-making, empowering them to navigate the complexities of investing with clarity and confidence.

Share This Book 📚

More Books in Investing

Poor Charlie's Almanack

Charlie Munger

Antifragile

Nassim Nicholas Taleb

Skin In The Game

Nassim Taleb

Thinking In Bets

Annie Duke

Security Analysis

Benjamin Graham

The Dao of Capital

Mark Spitznagel

The Intelligent Investor

Benjamin Graham

The Psychology of Money

Morgan Housel

When Genius Failed

Roger Lowenstein

Bitcoin Billionaires

Ben Mezrich

Secrets of Sand Hill Road

Scott Kupor

The Black Swan

Nassim Taleb

The Most Important Thing

Howard Marks

The Success Equation

Michael Mauboussin

Charlie Munger

Tren Griffin

Expectations Investing

Michael Mauboussin

Fooling Some of the People All of the Time

David Einhorn

Layered Money

Nik Bhatia

Manias, Panics, and Crashes

Robert Aliber

Market Wizards

Jack Schwager

Mastering The Market Cycle

Howard Marks

Money

Tony Robbins

More Than You Know

Michael Mauboussin

Reminiscences of a Stock Operator

Edwin Lefevre

Stress Test

Timothy Geithner

The (Mis)Behavior of Markets

Benoit Mandelbrot

The Alchemy of Finance

George Soros

The Essays of Warren Buffett

Lawrence Cunningham & Warren Buffett

The Most Important Thing Illuminated

Howard Marks

The Tao of Charlie Munger

David Clark

Popular Books Recommended by Great Minds 📚

Homo Deus

Yuval Noah Harari

The Dao of Capital

Mark Spitznagel

Bad Blood

John Carreyrou

Foundation

Isaac Asimov

Originals

Adam Grant

Thinking, Fast and Slow

Daniel Kahneman

Meditations

Marcus Aurelius

The Intelligent Investor

Benjamin Graham

The Three Body Problem

Cixin Liu

Snow Crash

Neal Stephenson

Behave

Robert Sapolsky

Hillbilly Elegy

J.D. Vance

The Holy Bible

Various

The Lean Startup

Eric Reis

Destined For War

Graham Allison

The Ride of a Lifetime

Bob Iger

Antifragile

Nassim Nicholas Taleb

The Lessons of History

Will & Ariel Durant

Lying

Sam Harris

Range

David Epstein

Economics in One Lesson

Henry Hazlitt

Trailblazer

Marc Benioff

The Psychology of Money

Morgan Housel

The Internet of Money Volume 1

Andreas Antonopolous

Becoming Steve Jobs

Brent Schlender

How to Change Your Mind

Michael Pollan

Red Notice

Bill Browder

The Bitcoin Standard

Saifedean Ammous

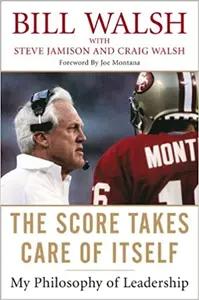

The Score Takes Care of Itself

Bill Walsh

The Autobiography of Benjamin Franklin

Benjamin Franklin