The Big Short

By Michael Lewis

Category

InvestingRecommended by

"The Big Short" by Michael Lewis is a gripping and eye-opening account of the 2008 global financial crisis. In this nonfiction book, Lewis walks readers through the events leading up to the crisis, uncovering the causes and consequences of the housing market collapse.

With meticulous research and a compelling narrative style, Lewis introduces us to a group of individuals who saw the impending crash and sought to profit from it. Through their unique perspectives and experiences, he highlights the flaws and inadequacies of the financial industry.

Lewis takes readers on a journey, explaining complex financial instruments such as subprime mortgages, collateralized debt obligations (CDOs), and credit default swaps (CDS). He unravels the web of deceit that characterized the mortgage market, exposing the rampant greed and reckless behavior of big banks, rating agencies, and Wall Street traders.

"The Big Short" sheds light on the disconnect between Wall Street and Main Street, as individuals and institutions were blindsided by the impending disaster. Lewis critiques the failure of regulators, government agencies, and economists in predicting and preventing the crisis.

Through vivid storytelling and colorful character profiles, Lewis captures the tension and anxiety of those who bet against the housing market, showcasing their audacity and foresight in the face of widespread denial.

Ultimately, "The Big Short" serves as a cautionary tale, offering valuable insights into the systemic issues that led to the financial crisis. Lewis compels readers to question the financial industry and its inherent flaws, prompting us to reflect on the lessons learned from this devastating event.

With meticulous research and a compelling narrative style, Lewis introduces us to a group of individuals who saw the impending crash and sought to profit from it. Through their unique perspectives and experiences, he highlights the flaws and inadequacies of the financial industry.

Lewis takes readers on a journey, explaining complex financial instruments such as subprime mortgages, collateralized debt obligations (CDOs), and credit default swaps (CDS). He unravels the web of deceit that characterized the mortgage market, exposing the rampant greed and reckless behavior of big banks, rating agencies, and Wall Street traders.

"The Big Short" sheds light on the disconnect between Wall Street and Main Street, as individuals and institutions were blindsided by the impending disaster. Lewis critiques the failure of regulators, government agencies, and economists in predicting and preventing the crisis.

Through vivid storytelling and colorful character profiles, Lewis captures the tension and anxiety of those who bet against the housing market, showcasing their audacity and foresight in the face of widespread denial.

Ultimately, "The Big Short" serves as a cautionary tale, offering valuable insights into the systemic issues that led to the financial crisis. Lewis compels readers to question the financial industry and its inherent flaws, prompting us to reflect on the lessons learned from this devastating event.

Share This Book 📚

More Books in Investing

Poor Charlie's Almanack

Charlie Munger

Antifragile

Nassim Nicholas Taleb

Skin In The Game

Nassim Taleb

Thinking In Bets

Annie Duke

Security Analysis

Benjamin Graham

The Dao of Capital

Mark Spitznagel

The Intelligent Investor

Benjamin Graham

The Psychology of Money

Morgan Housel

When Genius Failed

Roger Lowenstein

Bitcoin Billionaires

Ben Mezrich

Secrets of Sand Hill Road

Scott Kupor

The Black Swan

Nassim Taleb

The Most Important Thing

Howard Marks

The Success Equation

Michael Mauboussin

Charlie Munger

Tren Griffin

Expectations Investing

Michael Mauboussin

Fooling Some of the People All of the Time

David Einhorn

Layered Money

Nik Bhatia

Manias, Panics, and Crashes

Robert Aliber

Market Wizards

Jack Schwager

Mastering The Market Cycle

Howard Marks

Money

Tony Robbins

More Than You Know

Michael Mauboussin

Reminiscences of a Stock Operator

Edwin Lefevre

Stress Test

Timothy Geithner

The (Mis)Behavior of Markets

Benoit Mandelbrot

The Alchemy of Finance

George Soros

The Essays of Warren Buffett

Lawrence Cunningham & Warren Buffett

The Most Important Thing Illuminated

Howard Marks

The Tao of Charlie Munger

David Clark

Popular Books Recommended by Great Minds 📚

High Output Management

Andrew Grove

Titan

Ron Chernow

The Lean Startup

Eric Reis

High Growth Handbook

Elad Gil

Measure What Matters

John Doerr

Destined For War

Graham Allison

Security Analysis

Benjamin Graham

The Power of Habit

Charles Duhigg

Extreme Ownership

Jocko Willink

Thinking In Bets

Annie Duke

Billion Dollar Whale

Tom Wright

The Hitchhikers Guide to the Galaxy

Douglas Adams

Superforecasting

Philip Tetlock

The Lord of the Rings

J.R.R. Tolkien

The Dao of Capital

Mark Spitznagel

Einstein

Walter Isaacson

Zero to One

Peter Thiel

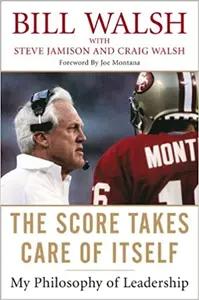

The Score Takes Care of Itself

Bill Walsh

Who We Are and How We Got Here

David Reich

The Internet of Money Volume 1

Andreas Antonopolous

Crossing the Chasm

Geoffrey Moore

The Network State

Balaji Srinivasan

American Kingpin

Nick Bilton

When Genius Failed

Roger Lowenstein

Range

David Epstein

Atlas Shrugged

Ayn Rand

The Almanack of Naval Ravikant

Eric Jorgenson

The Undoing Project

Michael Lewis

Originals

Adam Grant

The Three Body Problem

Cixin Liu