The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

By John Bogle

Category

InvestingRecommended by

"The Little Book of Common Sense Investing" by John Bogle is a comprehensive guide that imparts essential investing wisdom. Through a series of concise and practical lessons, Bogle demystifies the complexities of the financial markets and advocates for a simplified approach to investing.

Drawing on his vast experience as a pioneer of index investing, Bogle emphasizes the importance of passive investing strategies and highlights the pitfalls of active management. He demonstrates how low-cost index funds can deliver superior long-term investment returns while minimizing risks.

Bogle emphasizes the need for investors to focus on the long term, resist the urge to chase market trends, and avoid speculation. He promotes the idea of owning a diversified portfolio of low-cost index funds or exchange-traded funds (ETFs) and explains how this approach can lead to sustainable wealth accumulation.

Throughout the book, Bogle dispels common myths about investing and exposes the detrimental impact of excessive fees and transaction costs. He provides evidence-based insights to support his arguments and urges investors to prioritize simplicity, low expenses, and long-term discipline.

The book concludes with valuable advice on building an investment plan tailored to individual goals, risk tolerance, and time horizon. Bogle encourages readers to embrace the principles of common sense investing and offers guidance on how to stay on track during market turbulence and economic downturns.

In "The Little Book of Common Sense Investing," John Bogle presents a straightforward and indispensable guide for anyone seeking to navigate the complex world of investing with clarity, confidence, and long-term success in mind.

Drawing on his vast experience as a pioneer of index investing, Bogle emphasizes the importance of passive investing strategies and highlights the pitfalls of active management. He demonstrates how low-cost index funds can deliver superior long-term investment returns while minimizing risks.

Bogle emphasizes the need for investors to focus on the long term, resist the urge to chase market trends, and avoid speculation. He promotes the idea of owning a diversified portfolio of low-cost index funds or exchange-traded funds (ETFs) and explains how this approach can lead to sustainable wealth accumulation.

Throughout the book, Bogle dispels common myths about investing and exposes the detrimental impact of excessive fees and transaction costs. He provides evidence-based insights to support his arguments and urges investors to prioritize simplicity, low expenses, and long-term discipline.

The book concludes with valuable advice on building an investment plan tailored to individual goals, risk tolerance, and time horizon. Bogle encourages readers to embrace the principles of common sense investing and offers guidance on how to stay on track during market turbulence and economic downturns.

In "The Little Book of Common Sense Investing," John Bogle presents a straightforward and indispensable guide for anyone seeking to navigate the complex world of investing with clarity, confidence, and long-term success in mind.

Share This Book 📚

More Books in Investing

Poor Charlie's Almanack

Charlie Munger

Antifragile

Nassim Nicholas Taleb

Skin In The Game

Nassim Taleb

Thinking In Bets

Annie Duke

Security Analysis

Benjamin Graham

The Dao of Capital

Mark Spitznagel

The Intelligent Investor

Benjamin Graham

The Psychology of Money

Morgan Housel

When Genius Failed

Roger Lowenstein

Bitcoin Billionaires

Ben Mezrich

Secrets of Sand Hill Road

Scott Kupor

The Black Swan

Nassim Taleb

The Most Important Thing

Howard Marks

The Success Equation

Michael Mauboussin

Charlie Munger

Tren Griffin

Expectations Investing

Michael Mauboussin

Fooling Some of the People All of the Time

David Einhorn

Layered Money

Nik Bhatia

Manias, Panics, and Crashes

Robert Aliber

Market Wizards

Jack Schwager

Mastering The Market Cycle

Howard Marks

Money

Tony Robbins

More Than You Know

Michael Mauboussin

Reminiscences of a Stock Operator

Edwin Lefevre

Stress Test

Timothy Geithner

The (Mis)Behavior of Markets

Benoit Mandelbrot

The Alchemy of Finance

George Soros

The Essays of Warren Buffett

Lawrence Cunningham & Warren Buffett

The Most Important Thing Illuminated

Howard Marks

The Tao of Charlie Munger

David Clark

Popular Books Recommended by Great Minds 📚

Poor Charlie's Almanack

Charlie Munger

Trailblazer

Marc Benioff

The Ride of a Lifetime

Bob Iger

The Intelligent Investor

Benjamin Graham

Bad Blood

John Carreyrou

Who We Are and How We Got Here

David Reich

Hopping Over The Rabbit Hole

Anthony Scaramucci

Guns, Germs, and Steel

Jared Diamond

The Network State

Balaji Srinivasan

Surely You're Joking Mr. Feynman

Richard Feynman

Zero to One

Peter Thiel

Dune

Frank Herbert

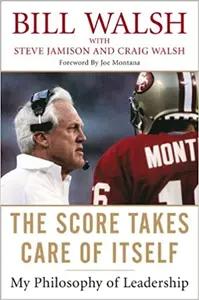

The Score Takes Care of Itself

Bill Walsh

Behave

Robert Sapolsky

Becoming Steve Jobs

Brent Schlender

Homo Deus

Yuval Noah Harari

The Psychology of Money

Morgan Housel

Destined For War

Graham Allison

Can't Hurt Me

David Goggins

How to Change Your Mind

Michael Pollan

The Coddling of the American Mind

Greg Lukianoff & Jonathan Haidt

Rework

Jason Fried

Loonshots

Safi Bahcall

The Checklist Manifesto

Atul Gawande

Lying

Sam Harris

Mindset

Carol Dweck

Thinking, Fast and Slow

Daniel Kahneman

Billion Dollar Whale

Tom Wright

Hillbilly Elegy

J.D. Vance

The Almanack of Naval Ravikant

Eric Jorgenson