The Theory of Investment Value

By John Burr Williams

Category

InvestingRecommended by

"The Theory of Investment Value" by John Burr Williams is a groundbreaking book that explores the principles and techniques of determining the true value of investments.

Williams introduces the concept of intrinsic value, emphasizing the importance of considering future cash flows and earnings potential when evaluating investments. He goes beyond mere speculation, providing a systematic and logical approach to properly assess an investment's worth.

Throughout the book, Williams lays out a comprehensive framework for valuing different types of assets, including stocks, bonds, and real estate. He emphasizes the significance of the time value of money, highlighting the role of interest rates and the impact they have on investment valuations.

In addition, Williams introduces the concept of the dividend discount model, which helps investors determine the present value of future dividend payments. He also discusses the role of earning power, growth prospects, and risk in evaluating an investment's value.

"The Theory of Investment Value" presents a clear and rigorous methodology for assessing investments, helping readers make informed decisions based on fundamental analysis. Williams' insights are essential for investors, financial professionals, and anyone interested in understanding the principles behind successful investing.

This timeless classic continues to be a valuable resource for anyone seeking to navigate the complex world of investment valuation, providing the tools and knowledge needed to make sound investment decisions. Williams' expertise and logical approach make this book an indispensable resource for investors of all levels of experience.

Williams introduces the concept of intrinsic value, emphasizing the importance of considering future cash flows and earnings potential when evaluating investments. He goes beyond mere speculation, providing a systematic and logical approach to properly assess an investment's worth.

Throughout the book, Williams lays out a comprehensive framework for valuing different types of assets, including stocks, bonds, and real estate. He emphasizes the significance of the time value of money, highlighting the role of interest rates and the impact they have on investment valuations.

In addition, Williams introduces the concept of the dividend discount model, which helps investors determine the present value of future dividend payments. He also discusses the role of earning power, growth prospects, and risk in evaluating an investment's value.

"The Theory of Investment Value" presents a clear and rigorous methodology for assessing investments, helping readers make informed decisions based on fundamental analysis. Williams' insights are essential for investors, financial professionals, and anyone interested in understanding the principles behind successful investing.

This timeless classic continues to be a valuable resource for anyone seeking to navigate the complex world of investment valuation, providing the tools and knowledge needed to make sound investment decisions. Williams' expertise and logical approach make this book an indispensable resource for investors of all levels of experience.

Share This Book 📚

More Books in Investing

Poor Charlie's Almanack

Charlie Munger

Antifragile

Nassim Nicholas Taleb

Skin In The Game

Nassim Taleb

Thinking In Bets

Annie Duke

Security Analysis

Benjamin Graham

The Dao of Capital

Mark Spitznagel

The Intelligent Investor

Benjamin Graham

The Psychology of Money

Morgan Housel

When Genius Failed

Roger Lowenstein

Bitcoin Billionaires

Ben Mezrich

Secrets of Sand Hill Road

Scott Kupor

The Black Swan

Nassim Taleb

The Most Important Thing

Howard Marks

The Success Equation

Michael Mauboussin

Charlie Munger

Tren Griffin

Expectations Investing

Michael Mauboussin

Fooling Some of the People All of the Time

David Einhorn

Layered Money

Nik Bhatia

Manias, Panics, and Crashes

Robert Aliber

Market Wizards

Jack Schwager

Mastering The Market Cycle

Howard Marks

Money

Tony Robbins

More Than You Know

Michael Mauboussin

Reminiscences of a Stock Operator

Edwin Lefevre

Stress Test

Timothy Geithner

The (Mis)Behavior of Markets

Benoit Mandelbrot

The Alchemy of Finance

George Soros

The Essays of Warren Buffett

Lawrence Cunningham & Warren Buffett

The Most Important Thing Illuminated

Howard Marks

The Tao of Charlie Munger

David Clark

Popular Books Recommended by Great Minds 📚

Mindset

Carol Dweck

Homo Deus

Yuval Noah Harari

Crossing the Chasm

Geoffrey Moore

Influence

Robert Cialdini

The Lean Startup

Eric Reis

The Lord of the Rings

J.R.R. Tolkien

Brotopia

Emily Chang

The Moment of Lift

Melinda Gates

Principles

Ray Dalio

7 Powers

Hamilton Helmer

Titan

Ron Chernow

1984

George Orwell

The Prince

Nicolo Machiavelli

Skin In The Game

Nassim Taleb

Behave

Robert Sapolsky

The Outsiders

William Thorndike

The Dao of Capital

Mark Spitznagel

Siddhartha

Hermann Hesse

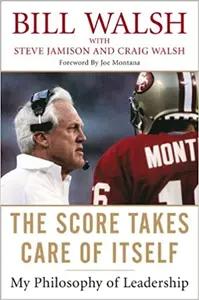

The Score Takes Care of Itself

Bill Walsh

The Bitcoin Standard

Saifedean Ammous

Hillbilly Elegy

J.D. Vance

Red Notice

Bill Browder

Thinking, Fast and Slow

Daniel Kahneman

Scale

Geoffrey West

The Lessons of History

Will & Ariel Durant

The Innovators Dilemma

Clayton Christensen

The Coddling of the American Mind

Greg Lukianoff & Jonathan Haidt

Guns, Germs, and Steel

Jared Diamond

Sapiens

Yuval Noah Harari

Give and Take

Adam Grant