Why Minsky Matters: An Introduction to the Work of a Maverick Economist

By L. Randall Wray

Category

EconomicsRecommended by

"Why Minsky Matters" by L. Randall Wray is an essential guide that explores the work and ideas of Hyman P. Minsky, an influential economist whose theories provide valuable insights into understanding financial crises.

Wray delves into Minsky's revolutionary concept of the "Financial Instability Hypothesis," which argues that stability in the financial system breeds instability, as periods of financial stability lead to excessive risk-taking. By analyzing Minsky's ideas, Wray demonstrates how his theories accurately predicted the 2008 global financial crisis.

The book examines Minsky's three financial sector balances—economic units' income-expenditure relations, liquidity preference, and changing financial structures. Wray illustrates how Minsky's framework offers a framework to grasp the dynamics of financial systems and their role in the economy's stability or vulnerability.

Moreover, "Why Minsky Matters" presents Minsky's unique insights into monetary policy, investment, and the role of the government in stabilizing the economy. Wray emphasizes the importance of Minsky's perspective as a guide for policymakers, financial analysts, and economists to prevent and mitigate future financial crises.

Throughout the book, Wray successfully demonstrates how Minsky's work deeply influenced and challenged conventional economic theories. He advocates for a fundamental shift in the way economics is taught, incorporating Minsky's wisdom to provide a more comprehensive understanding of financial and macroeconomic dynamics.

In summary, "Why Minsky Matters" is a concise and illuminating analysis of Hyman Minsky's essential contributions to the field of economics. Wray expertly presents Minsky's theories, offering a fresh perspective on financial instability and highlighting the relevance of Minsky's work in understanding and preventing future financial crises.

Wray delves into Minsky's revolutionary concept of the "Financial Instability Hypothesis," which argues that stability in the financial system breeds instability, as periods of financial stability lead to excessive risk-taking. By analyzing Minsky's ideas, Wray demonstrates how his theories accurately predicted the 2008 global financial crisis.

The book examines Minsky's three financial sector balances—economic units' income-expenditure relations, liquidity preference, and changing financial structures. Wray illustrates how Minsky's framework offers a framework to grasp the dynamics of financial systems and their role in the economy's stability or vulnerability.

Moreover, "Why Minsky Matters" presents Minsky's unique insights into monetary policy, investment, and the role of the government in stabilizing the economy. Wray emphasizes the importance of Minsky's perspective as a guide for policymakers, financial analysts, and economists to prevent and mitigate future financial crises.

Throughout the book, Wray successfully demonstrates how Minsky's work deeply influenced and challenged conventional economic theories. He advocates for a fundamental shift in the way economics is taught, incorporating Minsky's wisdom to provide a more comprehensive understanding of financial and macroeconomic dynamics.

In summary, "Why Minsky Matters" is a concise and illuminating analysis of Hyman Minsky's essential contributions to the field of economics. Wray expertly presents Minsky's theories, offering a fresh perspective on financial instability and highlighting the relevance of Minsky's work in understanding and preventing future financial crises.

Share This Book 📚

More Books in Economics

Principles for Dealing With The Changing World Order

Ray Dalio

The Rational Optimist

Matt Ridley

The Bitcoin Standard

Saifedean Ammous

Economics in One Lesson

Henry Hazlitt

The Ascent of Money

Niall Ferguson

Enlightenment Now

Steven Pinker

The Rise of the Rest

Steve Case

The Road to Serfdom

F.A. Hayek

The Wealth of Nations

Adam Smith

Capital In The 21st Century

Thomas Piketty

Check Your Financial Privilege

Alex Gladstein

Dealing with China

Henry Paulson

Debt

David Graeber

Human Action

Ludwig Von Mises

The Future of Capitalism

Paul Collier

The Prize

Daniel Yergin

The Wealth and Poverty of Nations

David Landes

Thinking In Systems

Donella H. Meadows

Trade Is Not A Four Letter Word

Fred Hochberg

Why Nations Fail

Daron Acemoglu

A Great Leap Forward?

John Mauldin & Worth Wray

A Guide To Econometrics

Peter E. Kennedy

Adaptive Markets

Andrew Lo

Age Of Ambition

Evan Osnos

An Apology for the Builder

Nicholas Barbon

Broken Money

Lyn Alden

Bureaucracy

Ludwig Von Mises

Capitalism Without Capital

Jonathan Haskel & Stian Westlake

Central Banking 101

Joseph Wang

Complexity and the Economy

W. Brian Arthur

Popular Books Recommended by Great Minds 📚

The Undoing Project

Michael Lewis

Behind the Cloud

Marc Benioff

The Outsiders

William Thorndike

Against The Gods

Peter Bernstein

The Lean Startup

Eric Reis

The Network State

Balaji Srinivasan

Thinking, Fast and Slow

Daniel Kahneman

The Hard Thing About Hard Things

Ben Horowitz

The Almanack of Naval Ravikant

Eric Jorgenson

The Intelligent Investor

Benjamin Graham

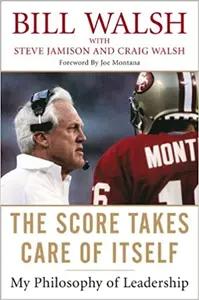

The Score Takes Care of Itself

Bill Walsh

High Output Management

Andrew Grove

High Growth Handbook

Elad Gil

Thinking In Bets

Annie Duke

Siddhartha

Hermann Hesse

Can't Hurt Me

David Goggins

The Ride of a Lifetime

Bob Iger

The Rise And Fall Of American Growth

Robert J. Gordon

Sapiens

Yuval Noah Harari

Economics in One Lesson

Henry Hazlitt

The Great CEO Within

Matt Mochary

The Fountainhead

Ayn Rand

Brotopia

Emily Chang

Give and Take

Adam Grant

The Power of Habit

Charles Duhigg

Blitzscaling

Reid Hoffman

Guns, Germs, and Steel

Jared Diamond

The True Believer

Eric Hoffer

Measure What Matters

John Doerr

Homo Deus

Yuval Noah Harari