Winning The Loser's Game

By Charles Ellis

Category

InvestingRecommended by

"Winning The Loser's Game" by Charles Ellis is a highly acclaimed investment guide that challenges conventional wisdom in the financial world. Drawing on decades of experience, Ellis presents a compelling argument for a passive investment approach, emphasizing the importance of minimizing costs and risk while maximizing long-term returns.

Ellis breaks down the fundamental concepts of investing, including the distinction between winners and losers in the market. He explains why attempting to beat the market through active management strategies is often futile, as the majority of professional managers consistently underperform over time.

Through clear and concise explanations, Ellis outlines the benefits of low-cost index funds and diversification, advocating for a balanced, disciplined approach that matches investment goals and risk tolerance. He also explores the psychological aspects of investing, shedding light on common pitfalls and biases that can hinder sound decision-making.

Moreover, Ellis highlights the importance of focusing on the long-term perspective and resisting the urge to react impulsively to short-term market fluctuations. He provides practical advice on constructing a well-diversified portfolio and demonstrates how an investor can achieve success not by outsmarting the market, but by understanding its inherent dynamics.

"Winning The Loser's Game" is a must-read for both novice and seasoned investors, offering valuable insights into the world of finance and empowering readers to make informed decisions that align with their financial goals. With its straightforward and accessible style, this book provides a solid foundation for anyone seeking to navigate the complex world of investing with confidence and competence.

Ellis breaks down the fundamental concepts of investing, including the distinction between winners and losers in the market. He explains why attempting to beat the market through active management strategies is often futile, as the majority of professional managers consistently underperform over time.

Through clear and concise explanations, Ellis outlines the benefits of low-cost index funds and diversification, advocating for a balanced, disciplined approach that matches investment goals and risk tolerance. He also explores the psychological aspects of investing, shedding light on common pitfalls and biases that can hinder sound decision-making.

Moreover, Ellis highlights the importance of focusing on the long-term perspective and resisting the urge to react impulsively to short-term market fluctuations. He provides practical advice on constructing a well-diversified portfolio and demonstrates how an investor can achieve success not by outsmarting the market, but by understanding its inherent dynamics.

"Winning The Loser's Game" is a must-read for both novice and seasoned investors, offering valuable insights into the world of finance and empowering readers to make informed decisions that align with their financial goals. With its straightforward and accessible style, this book provides a solid foundation for anyone seeking to navigate the complex world of investing with confidence and competence.

Share This Book 📚

More Books in Investing

Poor Charlie's Almanack

Charlie Munger

Antifragile

Nassim Nicholas Taleb

Skin In The Game

Nassim Taleb

Thinking In Bets

Annie Duke

Security Analysis

Benjamin Graham

The Dao of Capital

Mark Spitznagel

The Intelligent Investor

Benjamin Graham

The Psychology of Money

Morgan Housel

When Genius Failed

Roger Lowenstein

Bitcoin Billionaires

Ben Mezrich

Secrets of Sand Hill Road

Scott Kupor

The Black Swan

Nassim Taleb

The Most Important Thing

Howard Marks

The Success Equation

Michael Mauboussin

Charlie Munger

Tren Griffin

Expectations Investing

Michael Mauboussin

Fooling Some of the People All of the Time

David Einhorn

Layered Money

Nik Bhatia

Manias, Panics, and Crashes

Robert Aliber

Market Wizards

Jack Schwager

Mastering The Market Cycle

Howard Marks

Money

Tony Robbins

More Than You Know

Michael Mauboussin

Reminiscences of a Stock Operator

Edwin Lefevre

Stress Test

Timothy Geithner

The (Mis)Behavior of Markets

Benoit Mandelbrot

The Alchemy of Finance

George Soros

The Essays of Warren Buffett

Lawrence Cunningham & Warren Buffett

The Most Important Thing Illuminated

Howard Marks

The Tao of Charlie Munger

David Clark

Popular Books Recommended by Great Minds 📚

Billion Dollar Whale

Tom Wright

Destined For War

Graham Allison

High Growth Handbook

Elad Gil

Trailblazer

Marc Benioff

The Coddling of the American Mind

Greg Lukianoff & Jonathan Haidt

Bad Blood

John Carreyrou

Behind the Cloud

Marc Benioff

Masters of Doom

David Kushner

The Courage To Be Disliked

Ichiro Kishimi

Economics in One Lesson

Henry Hazlitt

Give and Take

Adam Grant

Creativity, Inc.

Ed Catmull

Blitzscaling

Reid Hoffman

The Prince

Nicolo Machiavelli

The Checklist Manifesto

Atul Gawande

Can't Hurt Me

David Goggins

The Ride of a Lifetime

Bob Iger

Sapiens

Yuval Noah Harari

Thinking, Fast and Slow

Daniel Kahneman

Meditations

Marcus Aurelius

Homo Deus

Yuval Noah Harari

Red Notice

Bill Browder

Crossing the Chasm

Geoffrey Moore

The Great CEO Within

Matt Mochary

When Genius Failed

Roger Lowenstein

The Network State

Balaji Srinivasan

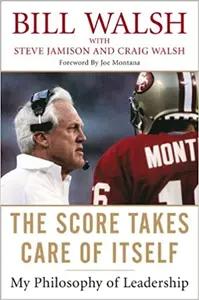

The Score Takes Care of Itself

Bill Walsh

The Third Wave

Steve Case

Dune

Frank Herbert

The Internet of Money Volume 1

Andreas Antonopolous